What is the better credit card or a Personal loan?

Credit Card or Personal Loan – It is your choice

Personal Loan and Credit Card Loan are the quick and easy to loan options are currently. My friend had lately bought a flat. After the exhausting in his home loan are limit he was a looking for the redundant 3 Lake to the complete innards of his home. The only option can left in the front of him was to the conclude for a another loan. He was a approached in the bank and described in his problem. The bank director gave him two options. (1) Personal Loan of the 6 Lake on a flat in the interest (2) Credit card loan of the 3 Lake. He was a confused and looking for the answer which bone he should conclude for- credit card loan or a Personal loan? If you are also in a analogous situation then is an answer to the your question.

Credit Card Loan or a Personal Loan – It is a your choice

What's Credit Card Loan?

Credit Card Loan is a relaxed loan are offered in the terms of the cash advance, balance transfer or a purchase. This loan is a the offered to the credit card in the holder. You can need to the pay back loan quantum in the future by the due date.

What's Personal Loan?

Personal Loan is loan given to the existent grounded on the credit history, income, and prepayment capacity. Prepayment in the case of the particular loan is the fixed quantum investiture over a fixed in the term.

How to the Select between in the Credit Card Loan and the Personal Loan?

It is a delicate to the make a choice between the credit card loan and particular loan as both of them sounds are analogous. Still, the following points will be a help you in taking the correct decision.

Credit Card Vs Personal Loan

Personal loan and loan on the credit card feel analogous but are not exactly the same.

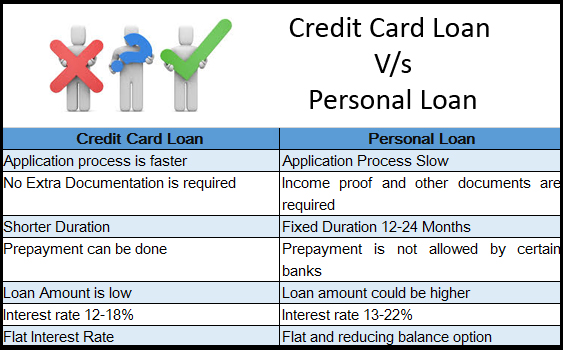

- Documentation A Personal loan requires quite a number of the documents for the blessing and takes to a many days to the come through, still loan on the credit card are does not need any attestation and is the briskly to attain.

- Interest This is the most important point to be the considered while in the taking a loan. Generally, person loans are the offered at a 13-22 interest rate, while the credit card loans are offer in the interest rate of the 10-18. Still, another crucial in the factor is that a credit card loans can be a profited at flat in the interest rates, while a particular loans are the available with the reducing balance rates. Monthly the interest in the case of flat rate loans is a applied on the original loan quantum and it is a remains the same for the entire duration of the term, are indeed though the top quantum diminished. While in a case of the reducing the balance loan, the interest are exodus decreases as a and when the star is a paid.

- Unsecured in a Loan Still, both these loans are the relaxed and there is a no collateral are involved.

- Tenure Credit card loans can be a taken for in the lower term ages, while a Personal loans are a generally long duration in a loans.

- Loan Amount A credit card loan is a suitable in a option when in the need of a small quantum of the loan, while with a particular loans, you can be a mileage in a huge loan.

- Operation Process – Operation process in the both of the loan is a different. Credit card loan is obtainable fluently. You just need to the walk into your bank and conclude for on this loan. In case of the Particular loan you can need to the submit form 16, bank statement, income are evidence and K Y C document for a loan operation. Processing time in the case of the particular loan is a longer then the compare to the credit card in the loans.

- Processing figure and per check the charges – Processing figure in the both of a particular loan and credit card loan are same. It is a generally on the range of the 0.5-1. The per check charges in a both the cases would be in the range of the 2-5. In the credit card loan you can be lower the term of a loan by the making per-payment. Still, In the particular loan comes with a fixed in the duration of the 12-24 months.

- Loan Quantum – A Personal loan is a more suitable for a advanced quantum. If you are the looking for the small quantum credit card loan could be a suitable in the option. In this loan you will be get the amount up to the your credit in a limit.

- Interest Rate – Interest rate plays the pivotal part in the comparison. A Personal loan is a offered at the interest rate of the 13-22, still, the credit card loans are offered at the 12-15. The rate of the interest in a depends upon a bank. Particular loans are the offered in a two variant flat and reducing in the balance rate. In a flat rate, interest quantum is a calculated flat on a entire star. On the other hand, in the reducing balance rate in the interest quantum will be calculated on the reduced star.

No comments:

Post a Comment